Understanding Your Philippine TIN

A Tax Identification Number (TIN) is your key to navigating various financial and government transactions in the Philippines. It's a mandatory requirement for almost everyone generating income, whether employed, self-employed, or running a business. Failing to obtain a TIN can lead to significant penalties and hinder access to essential services. This guide simplifies the acquisition process, covering both online and in-person methods.

Who Needs a TIN?

A TIN is required for a wide range of individuals and entities in the Philippines, including:

- Employed individuals: Those working for companies.

- Self-employed individuals: Freelancers, consultants, and entrepreneurs.

- Business owners: Sole proprietors, partnerships, and corporations.

Essentially, if you're engaged in income-generating activities in the Philippines, you'll likely need a TIN. It's crucial for paying taxes and accessing various government services. Do you need a TIN for other government transactions? Yes, many government services require a TIN including opening bank accounts.

Getting Your TIN: Online vs. In-Person

You can obtain your TIN through two primary methods: online or in-person at a Bureau of Internal Revenue (BIR) office.

Online Registration

While convenient, the online registration process is primarily designed for businesses registering their employees. Individuals seeking their own TIN typically find the in-person method more straightforward.

In-Person Registration at the BIR Office: A Step-by-Step Guide

This is the most common and recommended method for individuals. Follow these steps:

Gather Your Documents: You'll need a valid government-issued ID (driver's license, passport, etc.), proof of address (utility bill, bank statement), and potentially additional documents depending on individual circumstances. Always check the BIR website for the most up-to-date requirements.

Locate Your Nearest BIR Office: Use the BIR website's office locator tool to find the nearest office. This saves time and travel.

Obtain and Complete the Application Form: Get the TIN application form at the BIR office and fill it out accurately and completely. BIR representatives can assist if needed.

Submit Your Application: Submit the completed form along with your required documents.

Receive Your TIN: You'll typically receive your TIN immediately after submission. In some cases, a brief wait may be necessary.

Required Documents: A Quick Checklist

The exact documents required might vary, so always verify with the BIR website. However, these are commonly needed:

- Valid Government-Issued ID (Passport, Driver's License, National ID)

- Proof of Address (Recent Utility Bill, Bank Statement)

- Additional documents (May be required depending on individual circumstances)

Navigating the Nuances: Understanding Your TIN

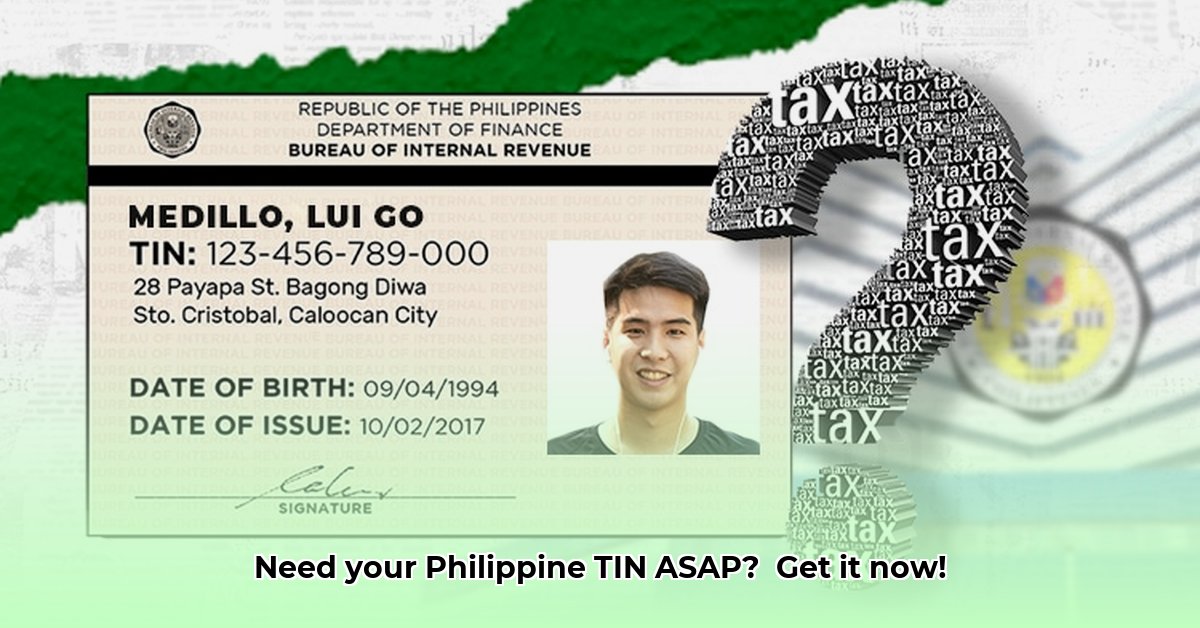

Your TIN will be a unique alphanumeric identifier. The structure might indicate your taxpayer type and issuance date. Executive Order (EO) No. 98 expanded the TIN's use beyond taxation, making it essential for various government transactions. Non-compliance can result in penalties. Do you know how many digits your TIN will have? Typically, it ranges from nine to twelve digits.

Frequently Asked Questions (FAQs)

- What if I lose my TIN card? You don't need a new TIN. Contact the BIR to report it as lost and obtain a copy of your information.

- What are the penalties for non-compliance? Penalties can include fines and legal repercussions.

- How long does the process take? The process usually takes a short time, but occasional delays may occur.

- Can I renew my TIN? No, a TIN is a one-time registration.

Need More Help?

Consult the official BIR website for the latest information, forms, and contact details. They are your best resource for any additional questions or concerns. The BIR website is a valuable tool that has an office locator to help you find the nearest BIR office.